Eicher Motors Limited (EML), parent company of iconic Royal Enfield motorcycles delivered stellar March Quarter 2023 earnings. Eicher Motor’s stock price jumped 6% after Q4FY23 results were announced. The leisure biker reported its highest ever quarterly revenues and profit after tax (PAT) aided by strong volumes and robust export performance. EML’s revenue growth was highest in FY23 in the listed Indian two-wheeler space. After the success of Hunter, launched in August 2022, new models to be launched in the second half of FY24 are eagerly awaited. Investors are keenly watching whether Royal Enfield will be able to maintain its growth momentum in FY24 in both domestic and export markets.

Highlights:

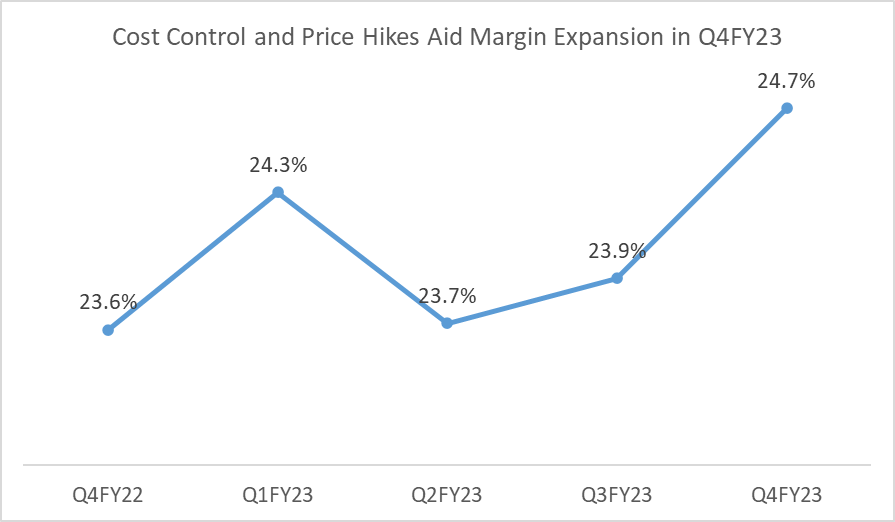

- Operating margin at 24.7% expanded 100 basis points (bps) YoY supported by cost control measures and price hikes

- Royal Enfield Hunter distribution reach will be expanded into tier 2, tier 3 and rural areas in India

- Shotgun 650, Himalayan 450 cc and Scrambler 650 are expected to be launched in 2024

- Royal Enfield electric motorcycle is expected to be launched in 2025-26

Stellar March Quarter 2023 Quarter

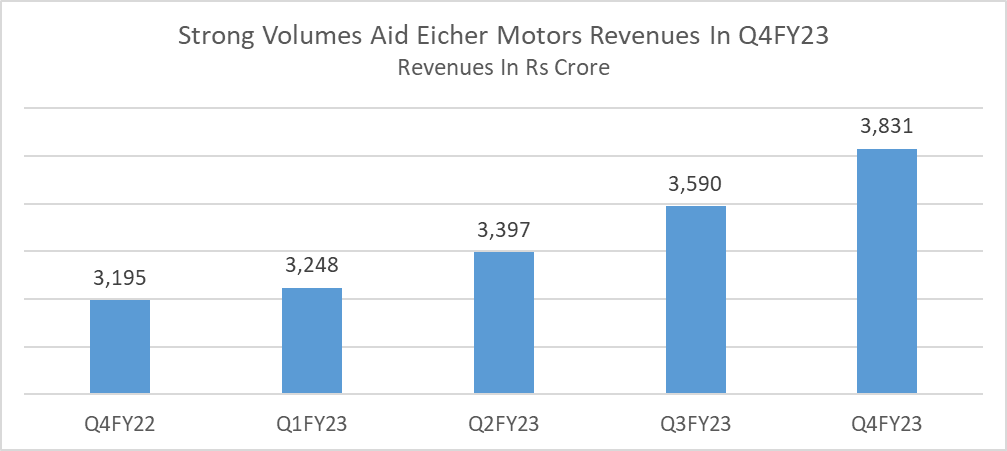

Eicher Motors reported fifth consecutive quarter of highest revenues (standalone) at Rs 3,831 crore up 20% YoY in Q4FY23. Topline growth was driven by strong volumes and higher average selling price (ASP). ASP at Rs 1.75 lakh was up 2% YoY and 7.7% sequentially in Q4FY23. The company sold 214,685 motorcycles, up 18% YoY in March Quarter 2023.

Speaking on March quarter performance, B. Govindarajan – CEO, Royal Enfield said, “Our demand is continuing to stay very resilient. It’s actually further getting added by our new motorcycle launches for which we got an excellent response from our consumers.” The company launched the Hunter 350cc, Scram 411cc, and Super Meteor 650cc in 2022. Aided by cost control measures, better product mix and price increases, operating margin at 24.7% expanded 100 basis points (bps) YoY and 80 bps sequentially in Q4FY23.

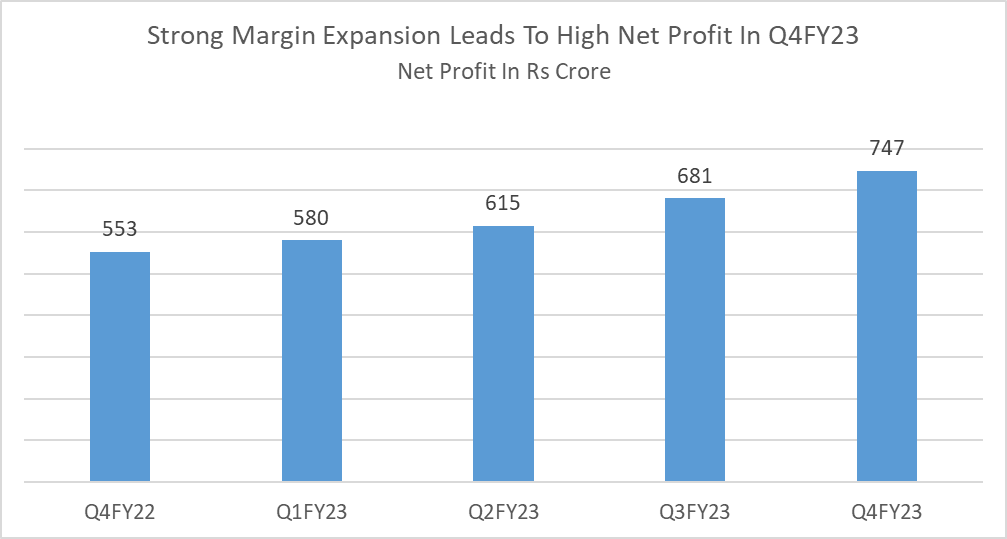

Strong margin expansion led to net profit growing 1.4x YoY in March Quarter 2023. EML reported PAT at Rs 747 crore, a rise of 10% QoQ in Q4FY23.

Hunter drives Royal Enfield’s Volumes in FY23

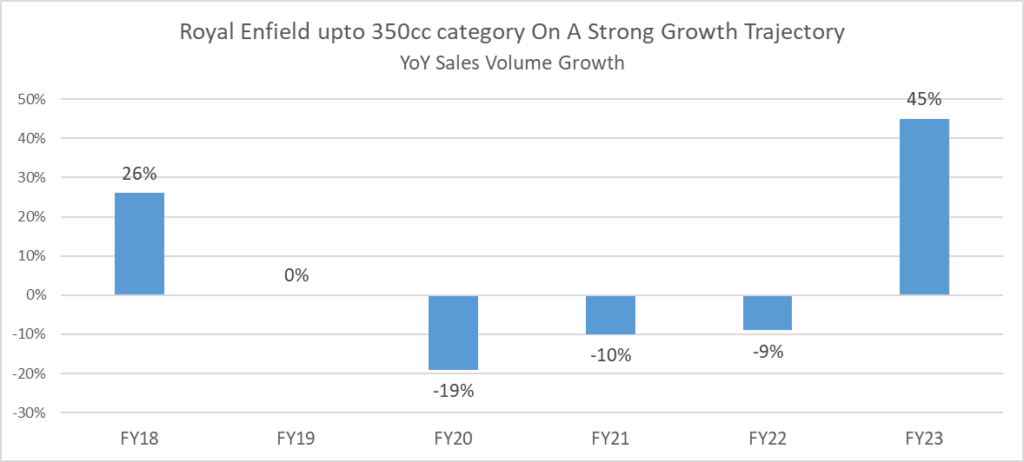

Eicher Motors manufactures iconic Royal Enfield mid-sized motorcycles (250cc – 750cc). Royal Enfield is the standalone business of Eicher Motors. Motorcycles upto 350cc category constitutes more than 85% of its total volumes. Royal Enfield’s total volumes fell 2% YoY and 9% YoY in the 350cc category in FY22 impacted by Covid disruption and semiconductor shortages. And then came Hunter 350cc in August 2022. Hunter was launched after being in the development stage for about 6 years. Worth the wait, Hunter has been a great success garnering strong volumes both domestic and in markets such as the US, UK and Europe.

Royal Enfield has cultivated leisure motorcycling culture in India with its iconic brands, Bullet and Classic 350cc. Over the years, a niche customer base has been developed which is more aspirational in nature and sensitive to quality, stylish looks, engine performance than price. These customers do not mind going an extra mile on the money front to buy the aspirational Royal Enfield motorcycle. The latest Royal Enfield rage, Hunter with its beautifully styled, lighter and nimbler chassis is attracting both men and women customers. Affordable pricing of Rs 1.49 Lakh is another key ingredient for its rousing success. The 350cc category volumes driven by Hunter are now getting closer to peak FY17 levels.

While Bullet and Classic are still iconic products, Hunter drove Royal Enfield volumes in FY23. The company aims to launch Hunter in tier 2, tier 3 and rural areas in India and also in Latin American countries in 2023. Whether this growth momentum of the 350cc category is maintained in FY24, needs to keenly watched.

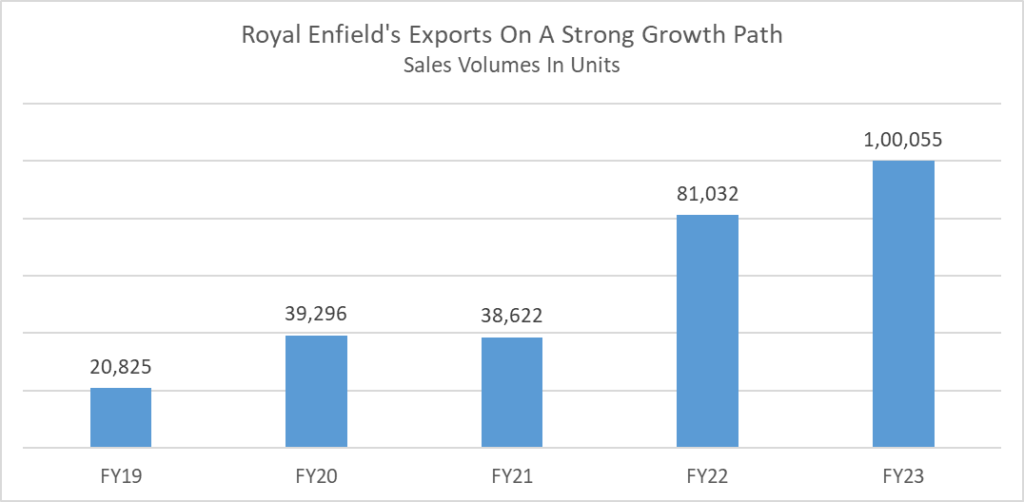

Exports on a strong growth trajectory

Royal Enfield crossed a significant milestone in its international journey by exporting 100,000 motorcycles in FY23. Exports have grown at a CAGR of 37% over the past five years. Export volumes have increased from 2.4% in FY18 to 10.7% of total volumes in FY23. Sales volumes increased 23% YoY in FY23. According to the management, despite a weak macroeconomic backdrop, retail growth in the international markets ranged between 27-45% across various regions in FY23.

Speaking about international growth, Govindarajan said, “Our market share in the middle weight segment across the markets has climbed, especially in Americas, about 7%, and APAC is almost 8.9%, and EMEA is about 8.8%.” Hunter 350 cc, Super Meteor 650, Continental GT and Interceptor are all contributing to strong export numbers. Royal Enfield’s fourth completely knocked down (CKD) plant commenced operations in Brazil in December last year. CKD plants are also there in Thailand, Argentina and Columbia. The company plans to start CKD facilities in Bangladesh and Nepal. Royal Enfield’s market share is around 8-9% globally in the mid-sized motorcycle segment. “Our international market ambition is very high because the addressable market is very good and our product is getting accepted very well”, said Govindarajan. The company aims to augment its market share in the one-million-unit middle-weight motorcycle segment in the near future.

Royal Enfield’s EV and upcoming models in FY24

Two-wheeler electric vehicle (EV) growth in India was more than 100% YoY in FY23. While currently the scooter segment is the flag bearer of the EV growth phase, motorcycles are expected to join in the next 2-3 years. Hero MotoCorp, Bajaj Auto and TVS Motors have their upcoming electric motorcycle models in the development phase. Royal Enfield is also not behind. The company has committed Rs 1,000 crore capital expenditure (capex) for development of new internal combustion engine (ICE) products and electric motorcycles. Royal Enfield made a strategic investment of EUR 50 million in Stark Future (Spain), an EV startup in December 2022. According to the management, Royal Enfield and Stark Future teams are working together, leveraging each other’s strengths in the development phase of the EV product. Speaking on Royal Enfield’s upcoming electric motorcycle, Govindarajan said, “We have to get a product which is very disruptive.” He further added, “Our focus as of now is all about getting the product right and working with the ecosystem and the suppliers to see that all the capacities are plotted and get the motorcycle on.” Royal Enfield is expected to launch its electric motorcycle in 2025-26. In addition to the EV, ICE products are also lined up to be launched next year. Shotgun 650, Himalayan 450 cc and Scrambler 650 are expected to be launched in 2024. Highly positive on upcoming products, Govindarajan said, “Our market share in motorcycles is only about 7-8% in India. There’s huge potential for us and Royal Enfield looks at actually developing the market rather than looking at only taking a pie out of it.” But so is the peer group. With Bajaj Triumph JV, launching its first mid-sized motorcycle in India in 2025, competitive mercury is definitely going to soar high.