Federal Bank reported its highest ever net profit of Rs 904 crore in March 2023 Quarter. Asset quality was stable with advances and deposits reporting 20% YoY and 17% YoY growth respectively in March 2023 Quarter. The stock price slid 8% intraday after Q4FY23 results were announced on May 5, 2023. Even with record net profit and highest ever operating profit in Q4FY23, the street was not impressed. After an all-round strong performance in previous quarter Q3FY23, Federal Bank disappointed investors reporting sequential and YoY fall in both net interest margin (NIM), net interest income (NII), higher slippages and provisions and lower CASA ratio in Q4FY23.

Highlights

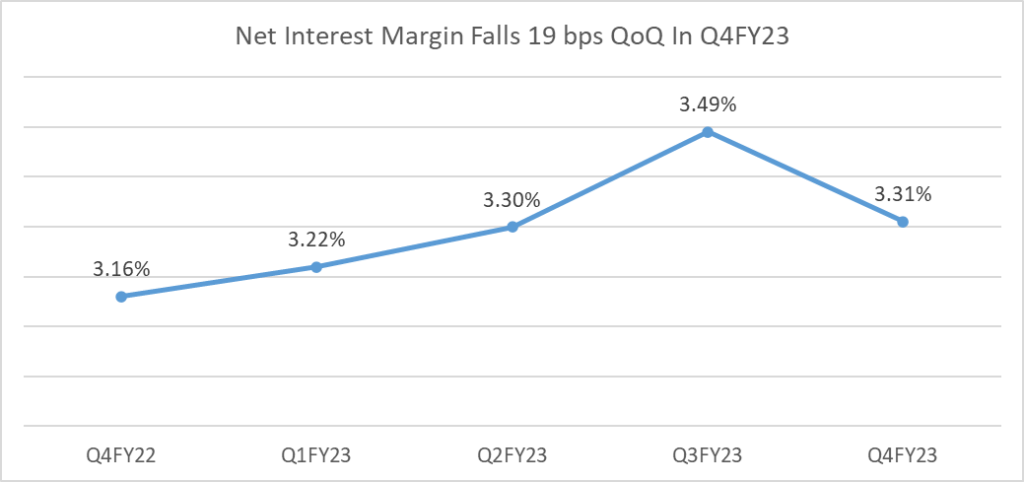

- NIM came in at 3.31% up 15 basis points (bps) YoY but with a sequential fall of 18 bps in Q3FY23

- Net interest margin is expected to remain in the range of 3.3-3.35% in FY24

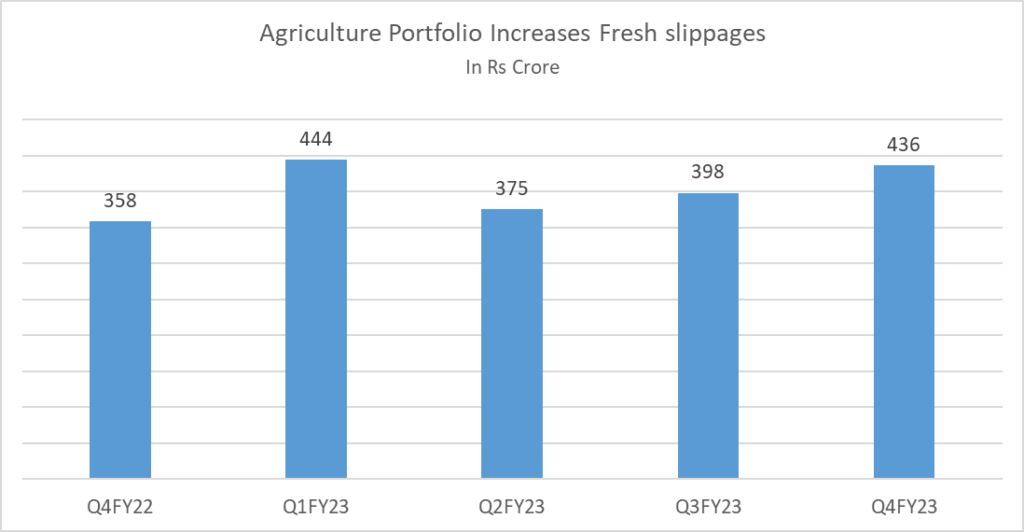

- Slippages at Rs 436 crore are up 22% YoY and 10% sequentially in March 2023 Quarter

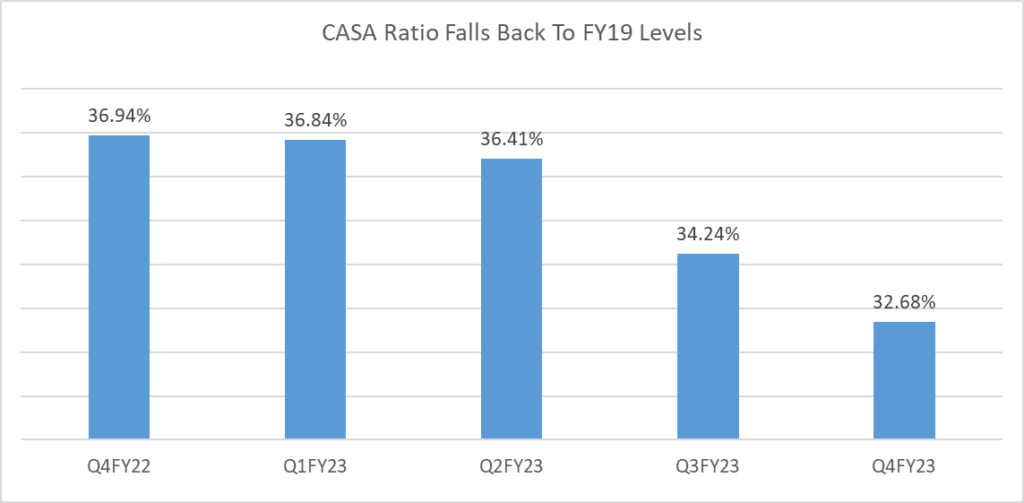

- After touching all time high of 37% in FY22, CASA ratio is back to FY19 levels of 32%

- The bank guided 100 branch openings in FY24

Sequential fall in NIMs and NII, asset quality stable

Net interest margin (NIM) came in at 3.31% up 15 basis points (bps) YoY but with a sequential fall of 18 bps in March 2023 Quarter. Fall in NIM (net interest income/average assets) is keenly followed by investors as it indicates profitability and operational efficiency of a bank. The ratio indicates how well the bank is able to manage its assets and liabilities. Speaking on Federal Bank’s NIMs, Shyam Srinivasan, Managing Director and CEO said that net interest margin will be maintained in the range of 3.3-3.35% in FY24. He further added that the bank will not take any disproportionate risk to increase NIMs which can create difficulties later.

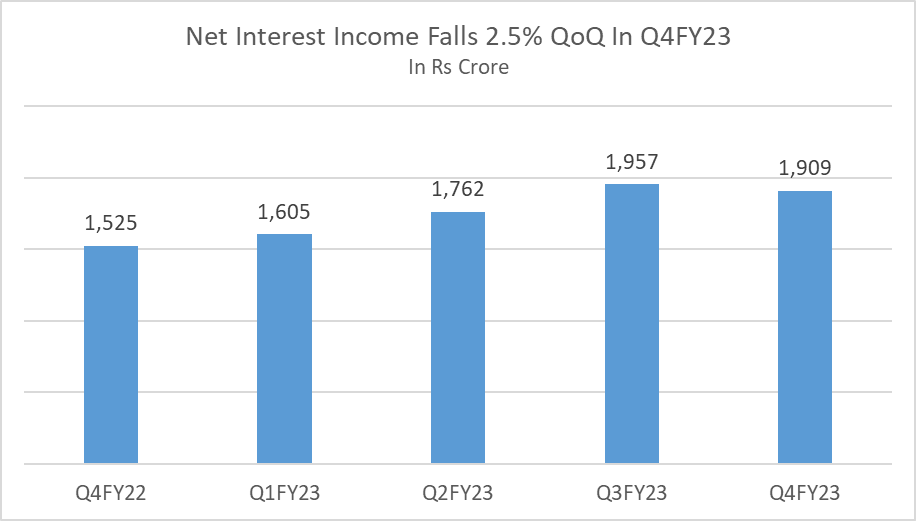

Net interest income (interest earned less interest expended) at Rs 1,909 crore rose 25% YoY but was down 2.5% QoQ in Q4FY23.

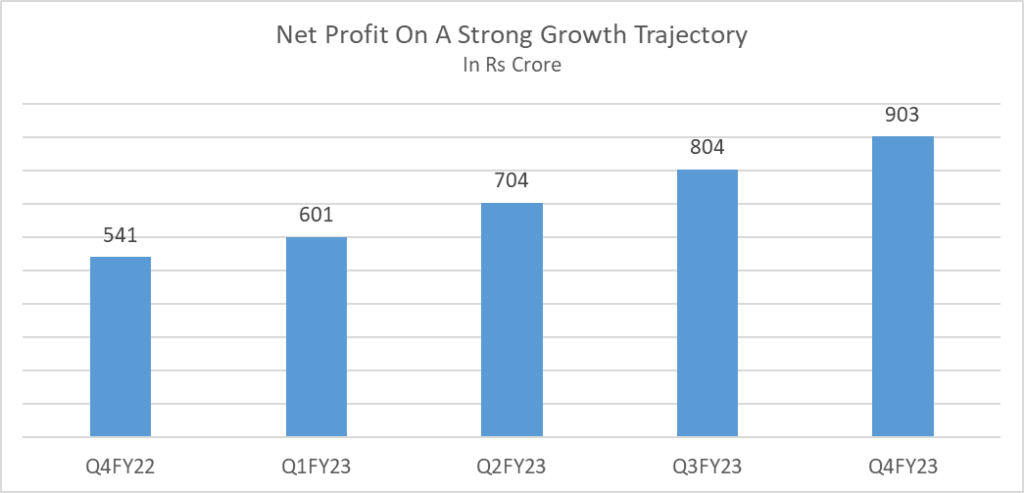

Federal bank’s net profit increased in double-digits both YoY and sequentially for a successive fourth quarter. Net profit increased 67% YoY to Rs 903 crore in March 2023 Quarter vs Rs 504 crore corresponding quarter previous year. Net profit was up 12% QoQ in Q4FY23.

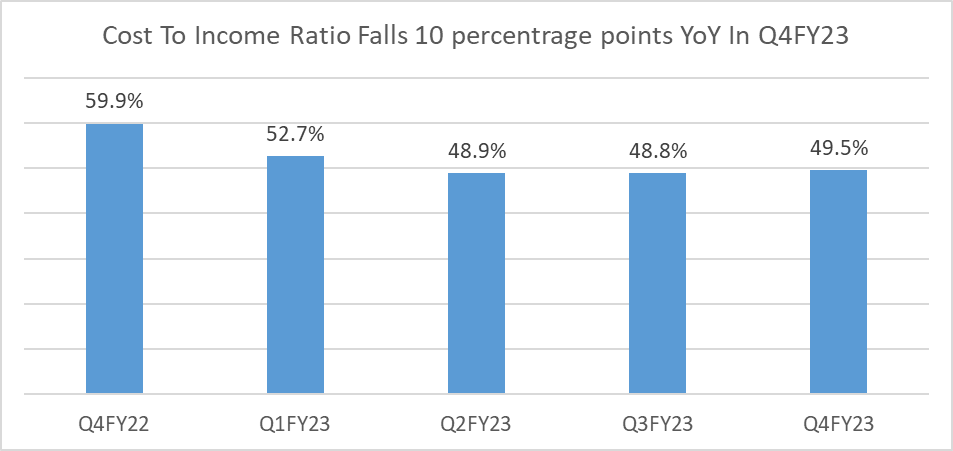

Lower cost to income ratio aided net profit growth for the bank in March 2023 Quarter. Cost to income ratio which is a profitability indicator fell more than 10 percentage points YoY in Q4FY23.

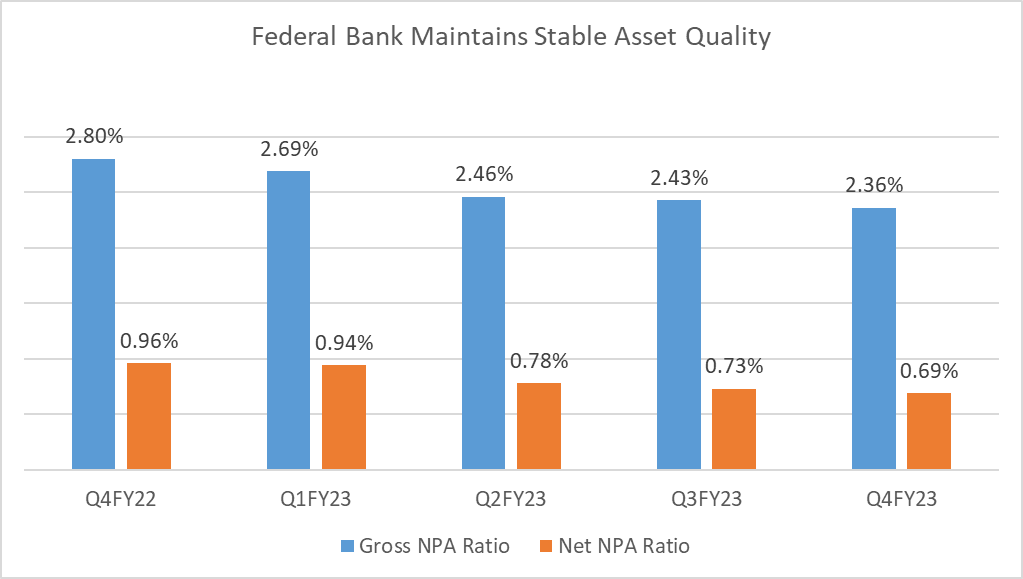

Stable asset quality, slippages increase

Asset Quality is stable and gross NPA ratio (% of gross NPAs to gross advances) and net NPA ratio (% of net NPAs to net advances) have been consistently falling over several quarters. Gross NPA at 2.36% is the lowest over the past 22 quarters. Net NPA ratio at 0.69% has also improved considerably over the past few years. Net NPA ratio in FY16 was 1.6%, which has improved with gradual increase in provisioning coverage ratio (PCR). Net NPAs are arrived at by reducing provisions from gross NPA amount. PCR (funds kept aside for NPAs) which was as low as 42% in FY16, is above 65% over the past four quarters. In Q4FY23, PCR stood at 70%.

While the asset quality looks good, slippages during Q4FY23 increased. Slippages at Rs 436 crore are up 22% YoY and 10% sequentially in March 2023 Quarter. Slippages refers to fresh accretion of NPAs during a specific period. Srinivasan said that slippages increased on account of some actions taken by the bank in the agriculture portfolio. He further added that the bank had guided slippages of around Rs 1,800 crore for FY23, which have come down to Rs 1600 crore by the end of the year.

Lower CASA ratio, advances increase in double-digits

Credit growth in FY23 was around 15% in FY23 compared to 10% YoY growth in deposits over the same period in the Indian economy. Complete reversal from 2021 when credit and deposit growth stood at 7% YoY and 9% YoY respectively. Hike in repo rate and RBI’s ‘withdrawal of accommodation stance’ has led to tightness in the banking system. While banks are raising interest rates for fixed and term deposits, fiercely competing with each other, investors are more interested in current account and savings account (CASA) ratio. CASA ratio is low-cost deposits garnered by the bank by paying an interest rate as low as 3%. Federal bank’s CASA ratio stands at 32.68% down 426 bps YoY and 156 bps sequentially in Q4FY23. This does not augur well for the bank. Lower the CASA ratio, higher will be the cost of deposits as the bank needs to spend more for attracting term and fixed deposits. Cost of deposits increased 12% sequentially to 5.12% in Q4FY23. CASA ratio, after touching an all time high of nearly 37% in FY22, Federal bank is again back to FY19 levels of 32%.

Lower proportion of high margin loan book impacts NIMs

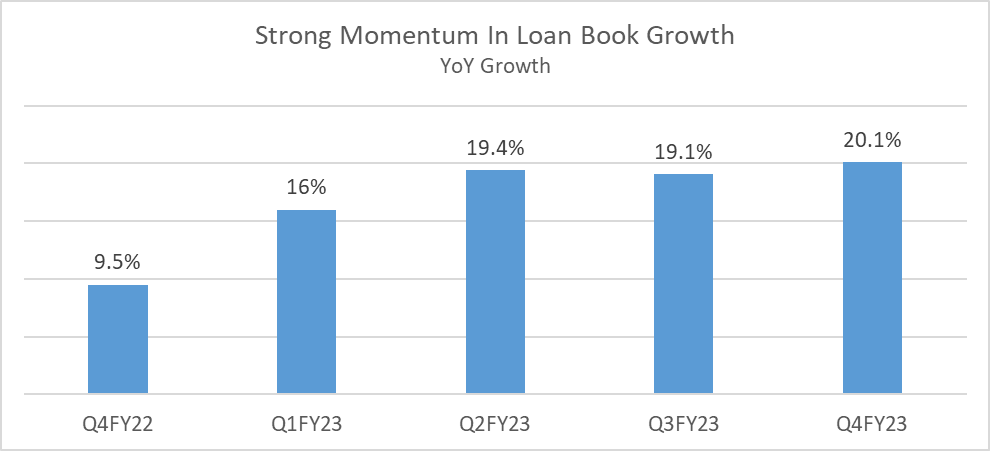

Federal bank’s advances grew 20% in the March 2023 quarter with all loan segments rising in strong double-digits.

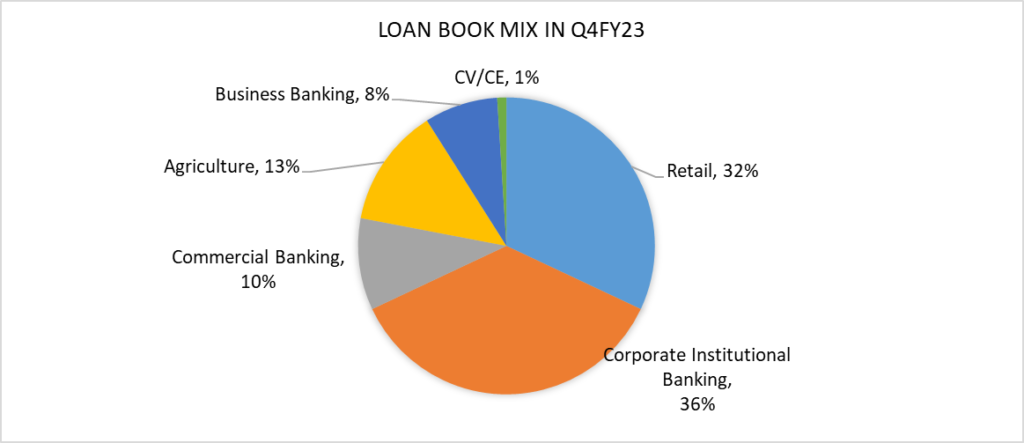

Corporate institutional banking (CIB) constitutes the largest chunk with 36% of total loan book and total wholesale loan portfolio which also includes commercial banking is 46%. High yielding retail loan book which constitutes housing, LAP, personal and auto is 32% of total loan book.

While loan book growth looks good, the high margin business constituting credit cards, commercial vehicle/construction equipment (CV/CE), micro, small and medium enterprises (MSME) and micro-finance constitutes only 19% of its total revenue share leading to lower expansion of NIMs. Gold loans with a high yield of 10.14% constituted just 10% of total retail loans. Though gold loans grew at nearly 15% YoY in Q4FY23, Srinivasan said that the bank has an internal cap of 15% for gold loans.

Federal bank’s stock price gained 56% from its 52-week low of Rs 82 last year. The stock price is currently at Rs 128. But it is down nearly 10% from its Rs 140 levels in January 2023. Investors which in December 2022 were gung-ho about Federal Bank’s growth prospects are now skeptical. Increase in fresh slippages and provisions in Q4FY23 did not go down well with the street. Federal Bank’s cost of deposits have increased 12% sequentially to 5.12% in Q4FY23 from 4.57% in previous year. This has impacted NII and NIM. While cost of deposits are expected to go up in the current competitive scenario, CASA ratio has also declined both YoY and sequentially. Significant drawback to deposit mobilization and credit growth is higher branch concentration in the state of Kerala. Kerala houses 44% of Federal Bank’s total branches. The bank has guided the opening of 100 branches in FY24. The bank needs geographical diversification and change in management stance towards high margin business to put growth wheels in motion.