Dabur India Q4FY23 results disappointed investors with its lackluster revenue and net profit growth. The stock price is down 1.5% reacting to weak March 2023 Quarter results. While revenue growth was modest at 6.4% YoY, net profit was flat in Q4FY23. Revenues and net profit came in at Rs 2,678 crore and Rs 293 crore respectively in March 2023 quarter. According to the management, the company faced high inflationary pressures which were partly mitigated by price increases. Dabur took price increases to the tune of 6% in Q4FY23. Operating margins stood at 19.8% down 215 basis points YoY in March 2023 Quarter. Operating margins were dented by higher cost of raw material (up 11% YoY) and other expenses (up 21% YoY) in Q4FY23.

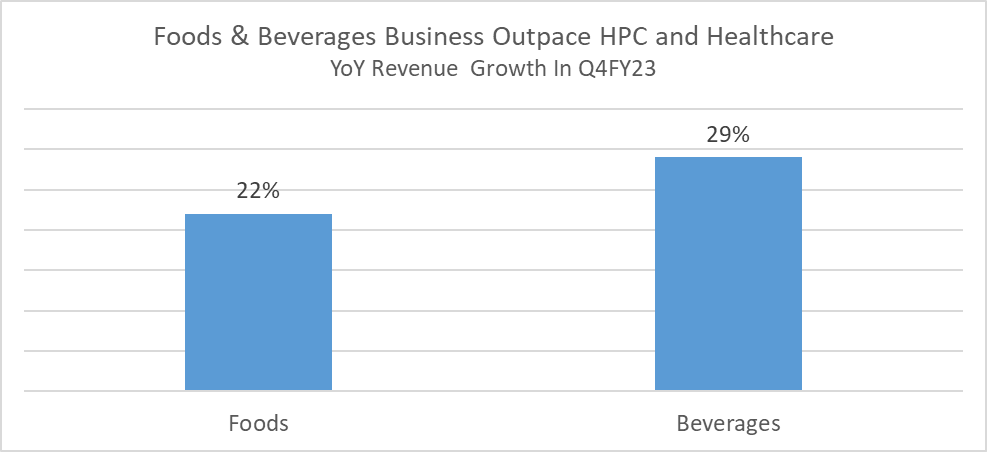

Ayurveda major, Dabur India has three major segments, home & personal care (HPC), healthcare and food & beverages. HPC, healthcare and foods & beverages contribute 47%, 32% and 21% of sales mix respectively. While HPC and healthcare reported muted revenue growth across their varied verticals, food & beverages reported healthy revenue growth numbers in Q4FY23.

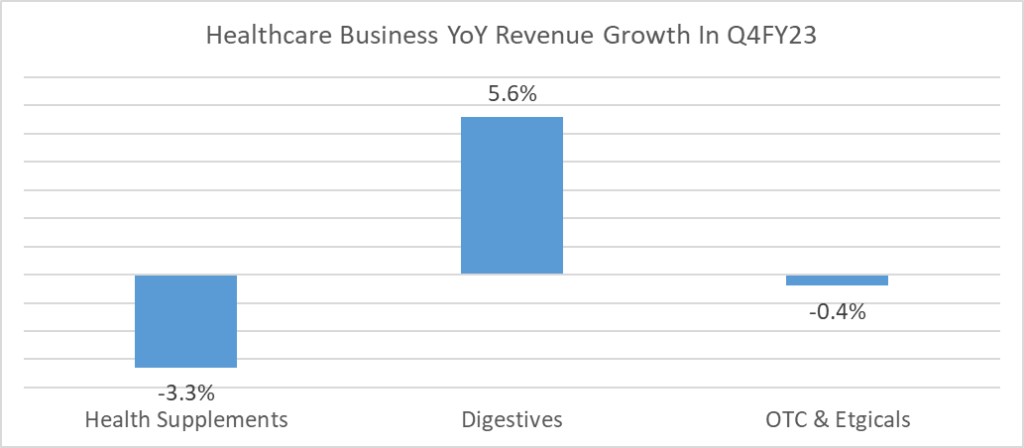

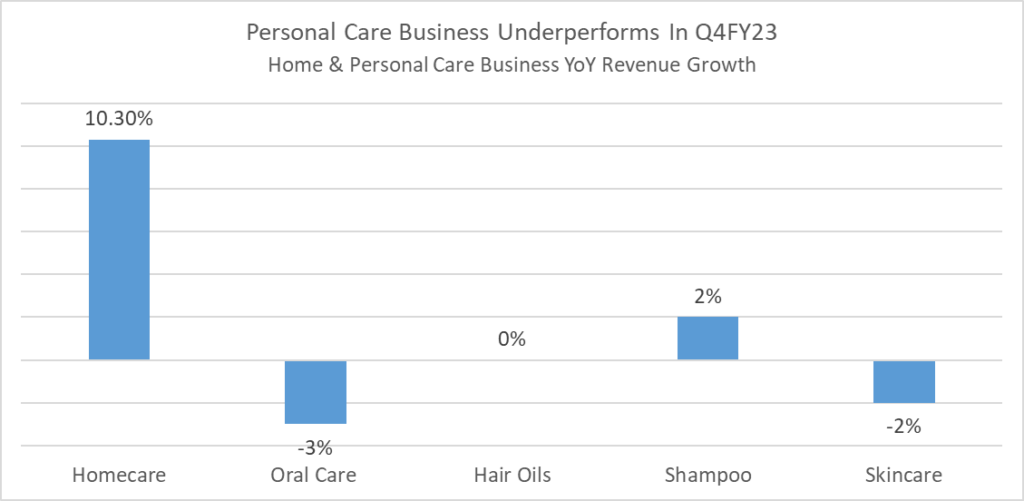

Home care vertical with brands such as Sanifresh, odomos and odonil reported strong double-digit revenue growth of 10.3% YoY in Q3FY23. On the other hand, health supplements and oral care revenue growth dipped 3% YoY in Q4FY23.

Dabur India reported strong growth numbers on the back of strong Covid tailwinds in FY21-22. With receding Covid headwinds, Dabur is feeling the heat with its health supplements such as Chyawanprash, Dabur honey witness lower sales. Skin care, shampoo and hair oils also face high inflationary pressures.

Dabur’s international business which constitutes 25% of total revenues reported a 9.6% jump in constant currency terms in Q4FY23 and 2.2% YoY in rupee terms. During the quarter, the Turkey business grew by 90%, while Egypt business was up 28% and Nepal business posted a growth of 17%.