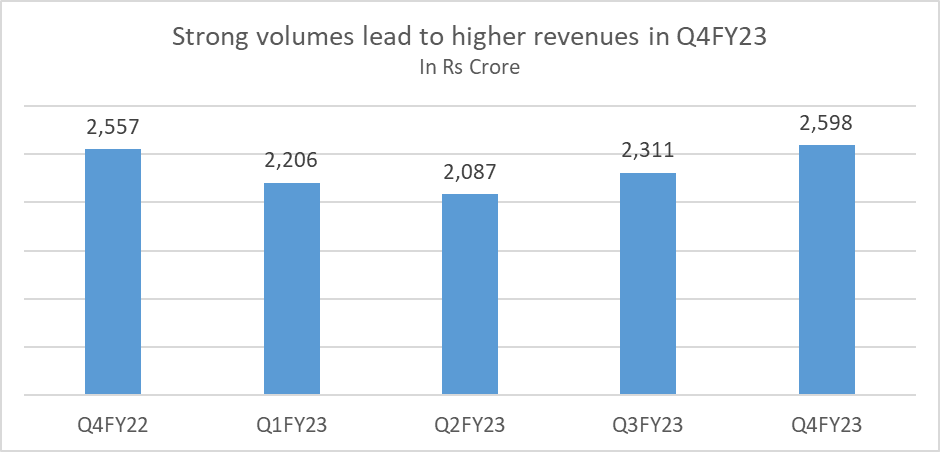

Supreme Industries stock price is near its 52-week high. The stock price gained 5% since its Q4FY23 results were announced on April 29, 2023. Supreme Industries is engaged in the processing of polymers such as polystyrene and expanded polystyrene (EPS), extruded polystyrene (XPS) and resins into finished plastic products. On a high base, the company’s revenues rose 2% YoY at Rs 2,598 crore driven by volume growth of 15% YoY in Q4FY23. Double-digit volume growth was supported by the plastic piping product segment which accounted for 76% of total volumes up 15% YoY in Q4FY23. Supreme Industries operates across four major segments, plastic piping products, packaging products, industrial products & consumer products with revenue contribution of 68%,12%, 14% & 5%, respectively in March 2023 Quarter.

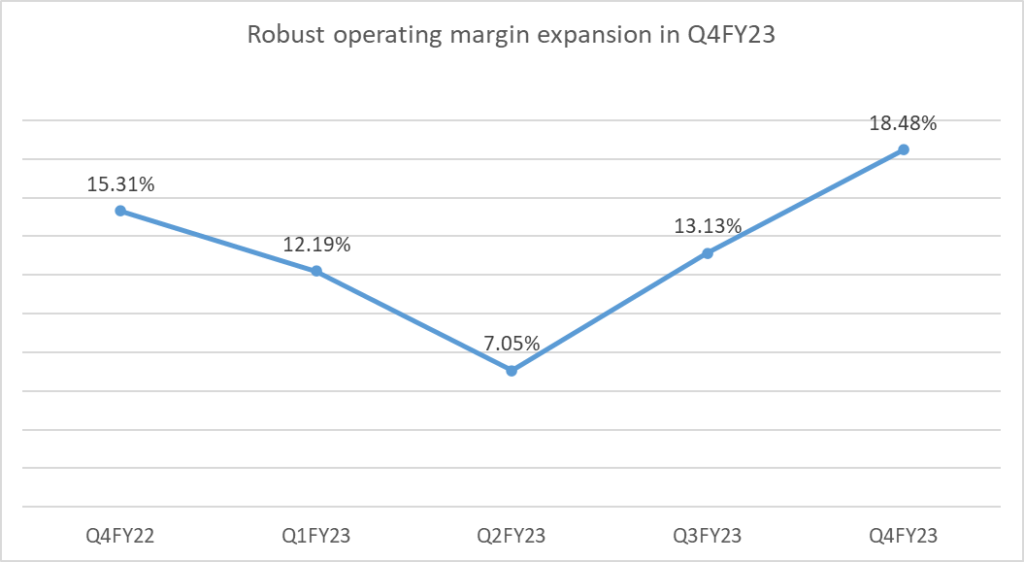

The company reported operating margins at 18.5%, up 320 basis points (bps) YoY in March 2023 Quarter. Healthy margin expansion was driven by lower cost of material (down 8% YoY) and higher realizations.

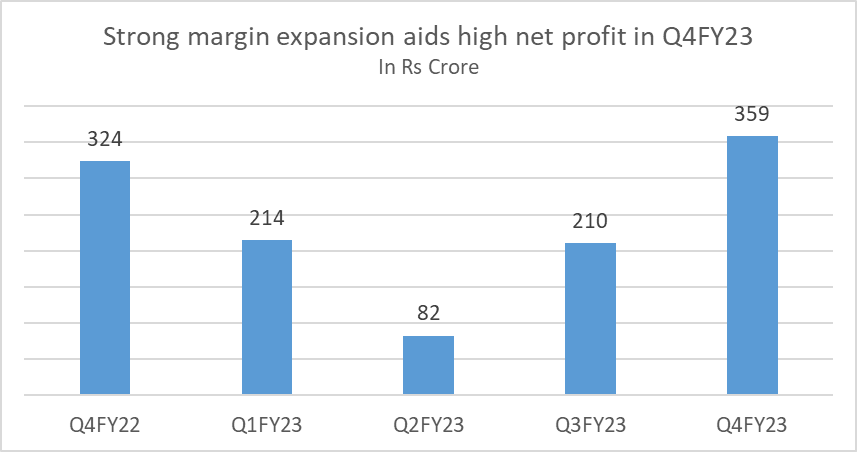

The management expects margins to be maintained at the current levels in the near future. According to the management, a higher proportion of premium products (with high realizations) in the sales mix also aided healthy margins and strong top-line growth. Premium products which were 25-27% of sales mix, three years back, are currently at 37-40%. Net profit for the fourth quarter FY23 stood at Rs 359 crore in Q4FY23 compared to Rs 324 core, same period previous year. Net profit grew 11% YoY in Q4FY23 supported by robust operating margin expansion.

Three greenfield units at Guwahati, Erode and Cuttack have become operational during the year, leading to 29% YoY volume growth in FY23. The company has also undertaken various brownfield expansions to increase its existing capacity. According to the management, higher capacity addition will help in increasing exports and meeting high domestic demand. The plastic processing industry was not able to meet domestic demand leading to 20% imports last year. The company also aims to revitalize its export growth which has been stagnant over the three years. The company reported export growth of 8% YoY in FY23. The management has given conservative guidance of 17% for volume growth for FY24.

Supreme Industries is also implementing a mass acrylonitrile butadiene styrene (ABS) project with two lines of 70,000 tonnes each aggregating 140,000 tonnes at its complex at village Amdoshi, Dist. Raigad, Maharashtra in technical collaboration with Versalis – Eni’s Chemical Company (Italy). Versalis is one of the largest producers of polymers in Europe. Presently polystyrene, expanded polystyrene (EPS) and extruded polystyrene (XPS) account 90% of Supreme Industries total revenues and mass ABS, master batch and compounds account for the remaining 10%. The company expects the mass ABS project’s full capacity to be operational in the next 2-3 years augmenting its volume growth further. According to the management, 45% of ABS requirement was imported last year in India with the total consumption of 45000 tonnes. The company expects ABS demand to grow strongly with the growth of the automobile sector and rapid growth of electric vehicle demand in India. ABS polymer has wide applications in automotive parts, household appliances, electric and electronic sector, medical appliances and furniture. The company has earmarked capital expenditure of Rs 750 crore for FY24.