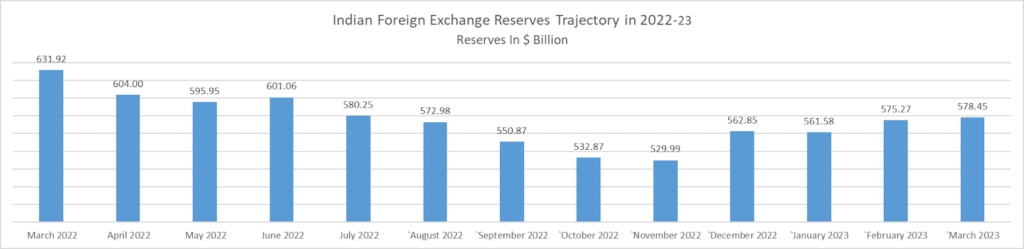

Indian rupee depreciated nearly 10% in 2022. Rupee touched 80 levels in July 2022. The Reserve Bank of India (RBI) intervened in the forward and spot market to manage rupee volatility. The Indian Central bank sold a considerable amount of dollars in 2022 to manage rupee volatility which led to fall in its foreign exchange reserves. From a high of $ 631 billion, foreign exchange reserves fell to $ 530 billion by November 2022.

US treasury yields impact forex reserves

RBI’s foreign exchange reserves mainly constitute foreign currency assets, gold, special drawing rights (SDR) in the International Monetary Fund (IMF) and reserve position in IMF. Foreign currency assets which mainly constitute US treasury bills form 88% of RBI’s foreign exchange reserves. Euro, pound, yen, swiss and other significant global currencies are also part of RBI’s foreign currency assets.

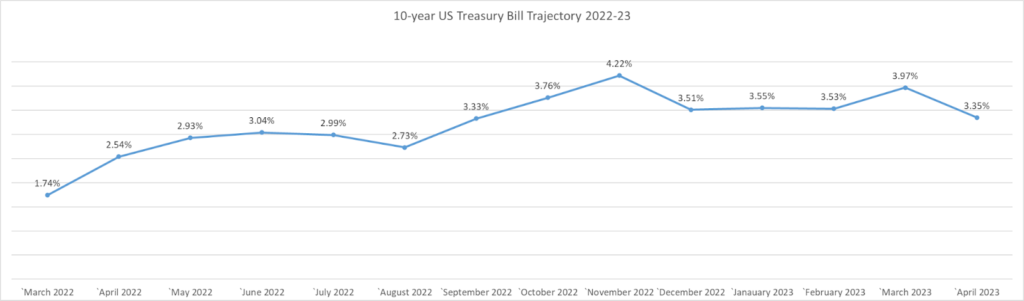

Tightening (increase) of interest rates by the US Fed led to fall in the value of US treasury bills or bond prices. Interest rates and bond prices move inversely. As the US Fed raised interest rates in March 2022 to rein in inflation, yields of US treasury bills rose and bond prices fell. Thus, rising interest rates led to a fall in value of US treasury bills in RBI foreign exchange reserves in 2022. Gold, which constitutes 6-7% of total reserves, also declined as gold prices fell with a shift in global investment from safe haven gold to high yielding US treasury bills backed by the US government.

US Fed interest rate hike slows down amid banking crises

The US Fed has raised interest rates twice in 2023. February and March interest rate hikes were 25 basis points each, taking the benchmark interest rate to 4.75% after nine consecutive interest rate hikes. The market expected a 50-basis points rate increase by the US Fed in March 2023. But the US Fed rate cycle seems to have slowed down amid SVB bank and Signature Bank Collapse. Economists hold the US central bank responsible for both banks’ fall in value of bond investment in a rising interest rate environment.

US treasury bills yield from a high of 4.22% in November 2022 have fallen to 3.53% in February 2023. Our forex reserves have thus improved considerably since October-November 2022. Though US treasury bills yield touched 4% in March 2023 again, they are down to 3.54% in April 2023. The US Fed is expected to slow down its interest rate hike or pause in May 2023. The US economy has also reported an increase in jobless claims, weak retail sales and consumer price inflation under control at 5% in March 2023.

RBI foreign exchange reserves, though lower than pre-pandemic levels, are still at high levels. India’s foreign exchange reserves at a nine month high as on March 2023.