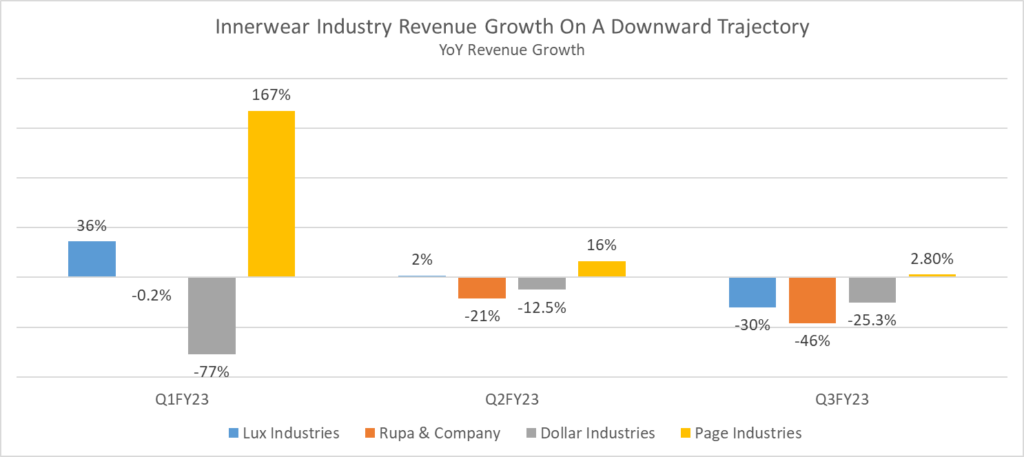

Page Industries, Lux Industries and Rupa & Company stock prices are at their 52-week low. Dollar Industries stock price has fallen 42% from its 52-week high. With poor December 2022 Quarter performance, stock prices of men, women & kids innerwear companies of the Indian listed space have fallen considerably. In fact FY23 has been tough for the Indian innerwear companies.

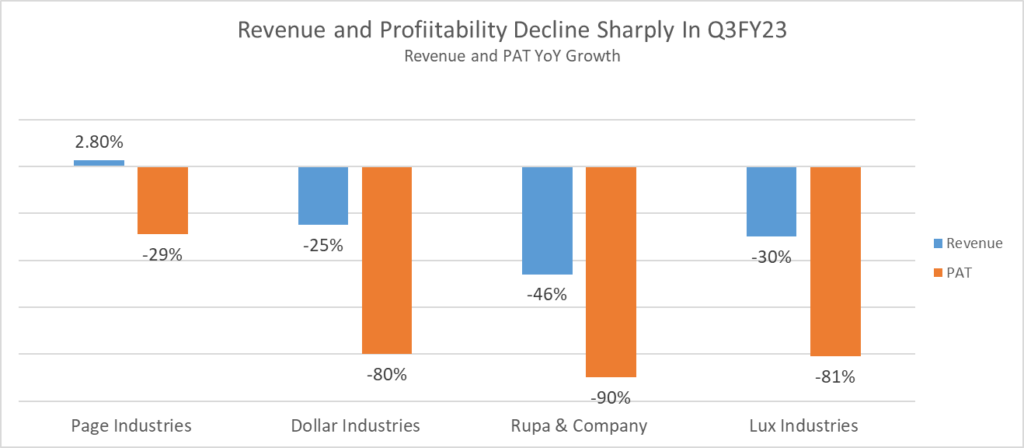

The December 2022 Quarter revenue growth has fallen in high double-digits for Dollar, Lux and Rupa innerwear, the main players in the economy segment. Economic slowdown and stretched family budgets impacted the economy innerwear segment more than the premium segment. Premium segment contributes between 10-20% of the revenue base for these three players. Thus, Page Industries, manufacturer of premium brand Jockey, reported relatively stable performance. Though intensity varies between economy players and Page Industries, reasons for lower revenue growth remain the same across the entire innerwear industry.

Demand slowdown is the main reason for lower growth. Speaking on lower revenue growth, V.S Ganesh, Managing Director at Page Industries said, “If somebody used to buy 4 pieces or 3 pieces, it has come down to 2 pieces. Maybe I think this is because of the general economic environment and it is a bit sluggish and people are conservative, I think very, very tight on expense.” Apart from lower demand, higher revenue base of Q3FY22 (price hikes taken by companies due to expected GST increase), high competitive intensity from unorganized players, late arrival of winter season (lower sales of thermals) and stunted growth in the athleisure segment led to lower revenue growth.

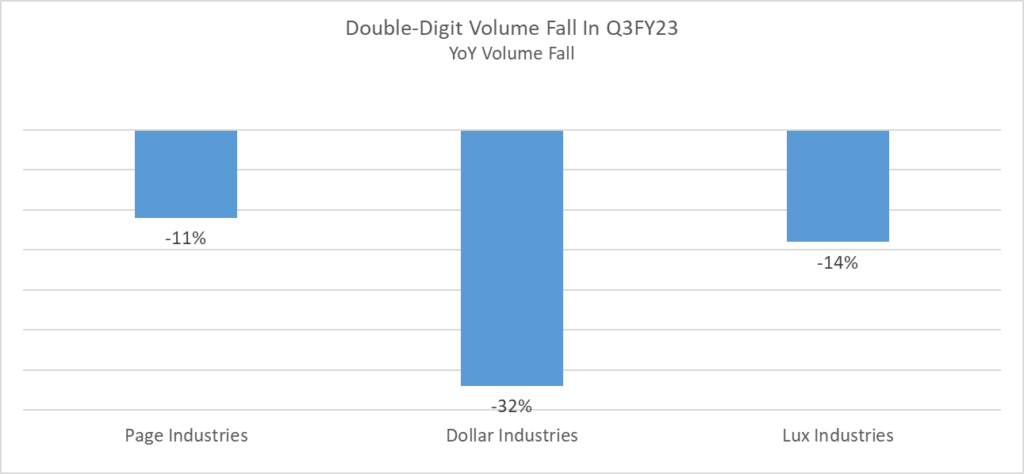

While Rupa & Company does not disclose volume data, all others reported double-digit YoY volume decline in Q3FY23.

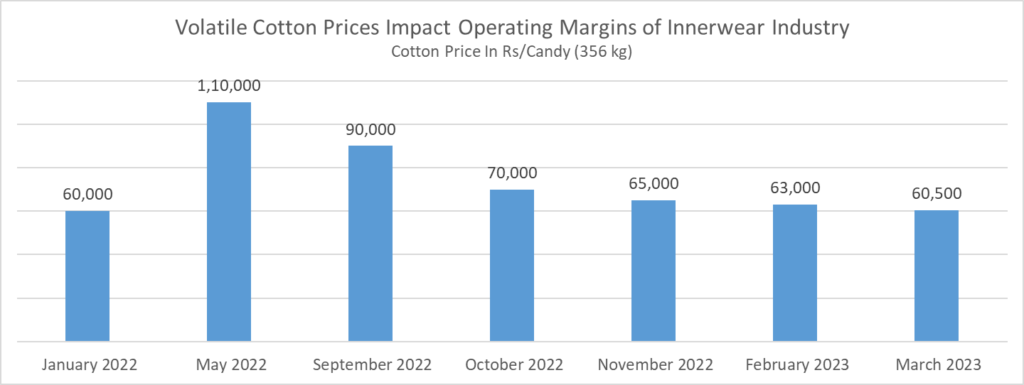

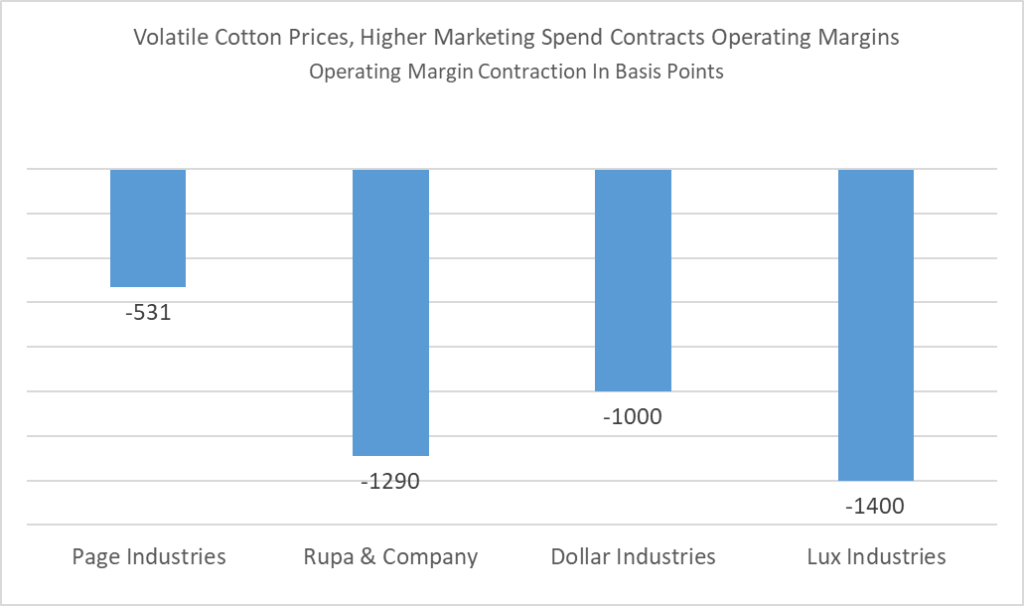

Operating margins declined sharply for the innerwear sector in Q3FY23. Volatile cotton prices throughout 2022 is a major factor for poor margin performance in FY23. Cotton prices rose sharply both in India and globally. Indian cotton prices increased due to lower production as a result of pest attacks and heavy rainfall destroying cotton crops.

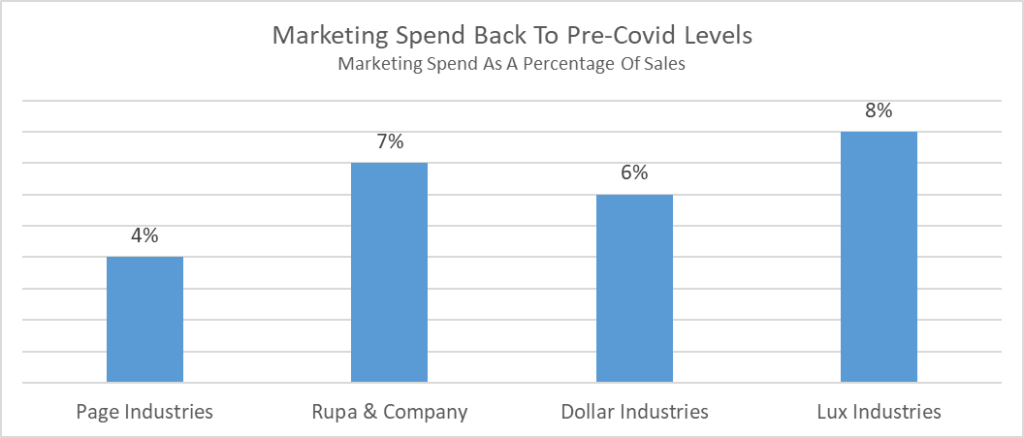

Owing to volatile swings in cotton prices, companies had stocked huge quantities of cotton raw material in 2022. Thus, utilization of raw material, which was purchased at a higher price in previous quarters resulted in lower operating margins in Q3FY23. In addition to higher raw material cost, lower absorption of labour and factory cost and normalcy in marketing and advertising spend also impacted operating margins in December 2022 Quarter.

March 2023 Quarter is expected to be better for operating margins as high-priced raw material inventory depletes and summer season demand is expected to increase volume growth. Stable cotton prices in 2023 have also given the necessary respite to the innerwear industry. As dealers and distributors replenish their stocks for the summer season, volumes are expected to rise, favorably impacting margins in Q4FY23.

All four players are optimistic of the upcoming summer season and expect growth to return in Q1FY24. Speaking on demand comeback, Ankit Gupta, President-Marketing at Dollar Industries said, “These are basic products. People cannot do away with innerwear. They can defer the purchase; they can postpone the purchase but can’t do away with it.” All players are strengthening their distribution network, allocating capital expenditure, and launching new products. Marketing and advertising spend is also back to pre-Covid levels.

Hopefully cotton prices should not go on a rampage similar to last year. Let’s keep our fingers crossed.